The pandemic is putting economies around the world to the test. The article discusses policy responses and economic consequences for Russia.

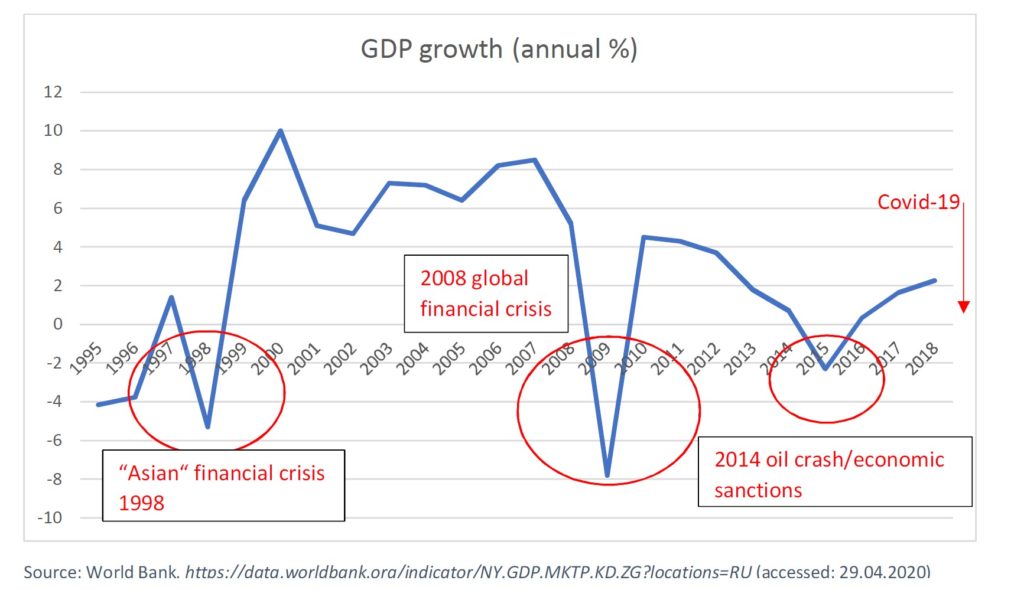

The Covid-19 pandemic not only represents a public health emergency, it also has detrimental effects for economies worldwide. Recent IMF growth projections1 estimate that global GDP will shrink by 3.0% in 2020; for the Russian economy, a contraction by 5.5% is expected. Some observers in Russia, including the head of the Russian Accounts Chamber and former Minister of Finance Alexei Kudrin2, draw an even darker picture with negative growth rates of 7–8% for the current year. Russia is thus entering the deepest economic crisis since the recession of 2008/2009 and its fourth recession in the past 22 years.

The State of the Russian Economy Before Corona

Perhaps due to this rich experience with economic crises, the Russian economy is surprisingly prepared to face COVID-19-related challenges. While it is true that a lack of structural reform, the dependence on raw material exports, and a difficult investment environment have slowed growth and hindered Russia’s successful integration into the global economy in the past two decades, Russian policymakers also got some things right. A prudent macro-financial policy and fiscal discipline have characterized Russia’s economic policy throughout the Putin years. This allowed Russia to accumulate considerable foreign exchange and gold reserves3 while maintaining a low foreign debt. The National Wealth Fund – which is formed from excessive revenue from energy exports and can be used to cushion the economy in times of crisis – surpassed the benchmark of 7% of GDP4, or $124bn, in August 2019.

Additionally, conflict with the West and mutual sanctions in the aftermath of the 2014 annexation of Crimea and conflict in Eastern Ukraine had a paradoxical effect in that they left Russia more resilient to a global economic crisis. The Russian economy today is more isolated and self-sufficient than it was before 2014, for instance in terms of the level of dependence on international capital markets. This makes it less vulnerable to a global downturn than many more complex and interconnected (Western) economies.

Small and Medium Enterprises at Risk

The Russian authorities thus have some room for maneuver when it comes to anti-crisis measures. Nonetheless, their response has been limited so far. In his first Corona-related address to the nation on March 25, 2020, President Vladimir Putin announced a set of decisions that were supposed to “ensure the social protection of our people, their incomes and jobs, as well as support for small and medium-sized businesses.”5 Other measures were added in the following weeks. Overall, the government response included direct payments to families, veterans of the Great Patriotic War, the unemployed and persons on sick leave; consumer loan and mortgage holidays; tax holidays for small and medium-sized enterprises (SMEs); as well as a reduction in the base interest rate from 6.00% to 5.50%.6

Many observers have pointed out that the stimulus package that has been announced, which amounted to around 3% of GDP by mid-April7, is (1) insufficient and (2) reproduces structural shortcomings of the Russian economy, thus setting the wrong priorities. A report published by the Liberal Mission Foundation and co-authored by leading liberal economists such as Sergey Guriev and Sergey Aleksashenko criticized that SMEs are left to bear the cost of the crisis.8 This criticism resonates with the fact that the Russian economy remains dominated by state-owned enterprises in strategic sectors such as energy and the military-industrial complex, both in terms of their actual economic contribution and the political importance assigned to them. As recently as March 2020, Vladimir Putin contended in an interview with the Russian news agency TASS that small and medium businesses in the 2000s were mainly run by “crooks” and that this situation is only changing due to the positive impact of large, state-regulated enterprises.9 The Corona crisis could even further reinforce the role of the state and increase concentration in the Russian economy, while many SMEs may not survive.

The Next Crisis Is Just Around the Corner: The Oil Price and the Russian Economy

Besides the immediate effects of quarantine measures, a second, closely related crisis hit the global energy markets in April. As global demand for oil plummeted, so did the oil price, in the United States even turning negative for the first time in history as storage facilities filled up.10 For Russia, as for all oil-exporting countries, this situation presents a serious challenge, especially because the Russian economy is so heavily dependent on energy. Oil and gas revenues have made up between 40% and 50% of the federal budget since the mid-2000s. 11 The 2020 budget plan operates with an average price level of $42.4 for oil as a break-even point, a scenario that turned out to be way too optimistic. Already in March, the Russian Ministry of Finance had warned of a budget shortfall of around $40bn due to falling energy prices.12 Corona thus exerts a double pressure on the Russian state budget: spending must be increased to support businesses and uphold demand, while available financial means are shrinking.

Crisis as an opportunity for reform?

The economic consequences of the Covid-19 epidemic in Russia are very likely to be serious and prolonged. While Russian policymakers have demonstrated some degree of preparedness, the crisis has also amplified the many structural shortcomings of the Russian political economy: dependence on energy exports, a dominant role of the state in the economy, lack of support and opportunity for private investment and entrepreneurship, an ineffective administrative system unaccountable to the general public. All these factors held back Russia’s socio-economic development well before the Corona crisis. The last comparably deep recession in the context of the global economic crisis in 2008/2009 has led to an extensive political, academic and societal debate about the future of the Russian economy. Under the catchword of “modernization”, then-President Dmitri Medvedev admitted the need for comprehensive structural reform and called for diversification, deregulation and integration into the global economy. Could the Corona crisis represent a similar chance to reconsider Russia’s economic, or even societal and political model?

It can be argued that there is some degree of societal demand for change. By April 2020, Putin’s approval ratings had fallen to a 14-year low in the wake of widespread public criticism of the authorities’ response to the pandemic.13 There are reports of (so far isolated) protests from all over the country, with people expressing their discontent with the lack of support and protection.14 However, any truly open debate or significant change seem unlikely. Even the results of the 2009 “modernization” agenda have been very limited, if not nonexistent. Since then, Russia has become more authoritarian and internationally isolated, while the maintenance of political and economic stability – even at the cost of stagnation – have become the guiding logic of Putin’s regime. It is thus more likely that the Russian government will choose a strategy of muddling through and weathering the crisis, as it has in the past. 15

Featured image: Mos.ru via Wikimedia Commons / CC BY 4.0

- https://www.imf.org/en/Publications/WEO/Issues/2020/04/14/weo-april-2020 [↩]

- https://echo.msk.ru/news/2632066-echo.html [↩]

- https://www.themoscowtimes.com/2019/04/04/russia-s-central-bank-flip-flops-on-need-to-build-up-reserves-to-500-bln-a65086 [↩]

- https://www.minfin.ru/en/key/nationalwealthfund/statistics/?id_65=104686-volume_of_the_national_wealth_fund [↩]

- http://en.kremlin.ru/events/president/news/63061 [↩]

- https://www.cbr.ru/eng/press/keypr/ [↩]

- https://www.reuters.com/article/health-coronavirus-russia-costs/update-1-russias-measures-to-fight-coronavirus-crisis-to-be-worth-2-8-of-gdp-idUSL8N2C40P0 [↩]

- http://liberal.ru/lm-ekspertiza/koronakrizis-2020-chto-budet-i-chto-delat [↩]

- http://kremlin.ru/events/president/news/62975 [↩]

- https://www.rferl.org/a/a-negative-oil-price-what-in-the-world-is-happening-/30568505.html [↩]

- https://www.swp-berlin.org/fileadmin/contents/products/research_papers/2019RP02_klg.pdf [↩]

- https://www.reuters.com/article/us-russia-economy-budget/russia-faces-39-billion-budget-shortfall-in-2020-from-lower-oil-gas-revenues-idUSKBN2151VM [↩]

- https://wciom.ru/news/ratings/doverie_politikam/ [↩]

- https://www.yakutia.info/article/194701 [↩]

- https://www.rferl.org/a/week-in-russia-putin-pechenegs-pneumonia/30546450.html [↩]

Kommentare von Vera Rogova